Finance professors’ research instrumental in market regulations

February 27, 2020

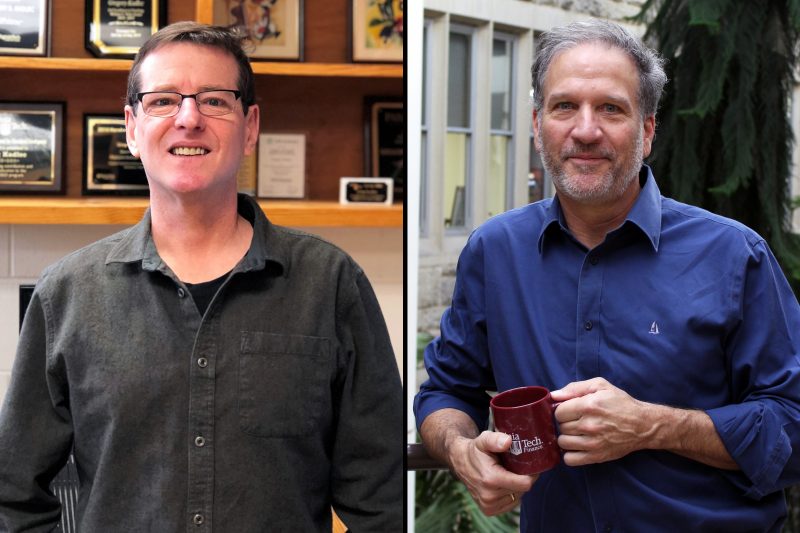

Greg Kadlec and Roger Edelen, professors with the Department of Finance in the Pamplin College of Business, are experts on agency conflicts in institutional money management. Several of their studies in this field have been published in top finance research journals and have been instrumental in shaping financial market regulation on institutional money management in the U.S. for the past 20 years. Their research has also played a key role in financial market regulation in Europe.

In their 2001 study in the Journal of Finance, “On the perils of security pricing by financial intermediaries,” Kadlec and Edelen outline a flaw in the way in which mutual funds price their shares (the net asset value, or NAV, reported at the end of each day). The authors document how this flaw allows opportunistic traders to exploit long-term “mom and pop” investors, at a cost of billions of dollars per year. This study was presented to the U.S. Securities and Exchange Commission (SEC) in 1999, long before the exploit became widely known. The study was also at the core of New York Attorney General Elliot Spitzer’s “market timing scandal” of 2003 and was featured in the New York Times and Wall Street Journal. As detailed in their Journal of Finance paper, the issue is fundamental and not easily fixed.

It remains relevant today, and the authors remain at the center of the matter, having been recently invited to speak at the SEC’s 2020 Conference on Financial Market Regulation in Washington, D.C.

Kadlec and Edelen’s 2012 study, “Disclosure and agency conflict: evidence from mutual fund commission bundling,” published in the prestigious Journal of Financial Economics, examines the role of transparency in resolving agency conflicts in institutional money management. Financial market regulation is often introduced to address agency conflicts between investors and managers through better disclosure and transparency. Yet, surprisingly little is known about the effectiveness of disclosure and transparency in addressing agency conflicts.

Their study provides some of the first direct evidence regarding this issue in the context of mutual funds. It finds that mutual funds’ returns are significantly worse when fund managers use less visible “soft dollars” to pay an operating cost, rather than direct expensing. Soft dollars are an opaque form of payment for goods and services that can foster kickbacks and other incentives for fund managers to do other than what’s best for shareholders. These payments do not appear on the expense ratio where fund costs are typically tabulated and reported. Their evidence has been cited in government regulatory testimony in both the U.S. and Europe arguing for the prohibition of soft-dollar payments. Kadlec and Edelen were recently engaged to serve on the scientific committee for a conference in Madrid, Spain, to evaluate regulation by the CNMV (the Spanish SEC) to eliminate soft dollars.

Kadlec’s current research provides evidence regarding the effectiveness of Regulation Fair Disclosure, or Reg-FD, which prohibits firms from making preferential disclosure of relevant information to institutional investors, in an attempt to level the playing field between institutional and retail investors. His study suggests that Reg-FD has been effective in achieving its intended goals, but, as is often the case with regulation, it may have some unintended adverse consequences. In response to Reg-FD, It appears that some firms are inclined to release less information. Edelen is currently working on the role of disclosure of fees for financial advisory services.