Jin Xu receives Best Paper Award for research showing tax benefit of debt financing

September 30, 2019

Jin Xu, associate professor of finance in the Pamplin College of Business, has received a Best Paper Award for an article she co-authored that examines the effects of corporate taxes on corporations’ market values and provides important evidence for the tax benefit of debt financing.

The paper, “Taxes, Capital Structure Choices, and Equity Value,” published in the Journal of Financial and Quantitative Analysis and written with Mara Faccio, of Purdue University, quantifies the market value of the tax benefit of debt financing for firms.

Xu said their research showed that how much firms can save from corporate taxation is directly tied to the amount of debt financing in their capital structure.

“Corporations should take this into account in their decisions to raise capital, restructure, or conduct acquisitions,” she said. “When the government implements a new tax reform, such as the Tax Cuts and Jobs Act of 2017, firms should also assess its impact on their financing policies.”

Finance theory predicts that debt financing saves taxes, Xu said, but empirically identifying the tax benefit and estimating its magnitude have been challenging.

She and Faccio use data on tax reforms in the three dozen member countries in the Organization for Economic Cooperation and Development to estimate the market value of the debt tax benefit.

They found evidence that tax reforms are followed by large changes in the market value of corporate equity but that the impact of the reforms is greatly mitigated by debt.

“The value of debt tax savings is greater among top taxpayers, highly profitable firms, and in countries where tax laws are more strongly enforced,” Xu said. “Importantly, the value of debt tax savings is in line with the benchmark implied by classical theory.”

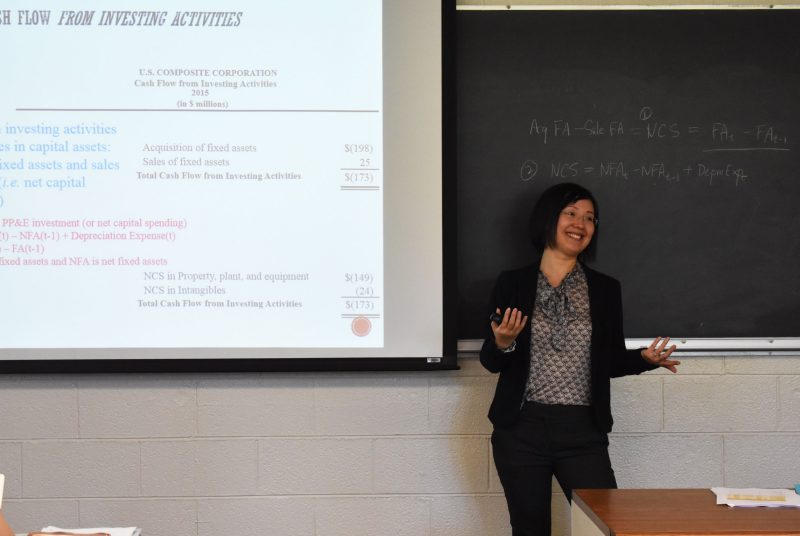

Xu teaches undergraduate and graduate courses in corporate finance. This is her second Best Paper Award.

— Written by Sookhan Ho; photo by Chris Marano

Learn more about Jin Xu

-

Bio Item